INVESTMENT MANAGERS

Invest with trusted names in the industry and explore diversification. Our third-party managers and trading system allow for blending multiple investment model selections together across different managers in the same account.

We offer a wide variety of financial services to our clients through many trusted names in the industry with a focus on diversification. Third-party investment management, special partnerships, and technology help to enhance our clients’ understanding of their financial situation and guide them towards achieving their long-term goals with confidence.

There are many potential vulnerabilities to your financial success. What are they and how should you handle them? Our advice is to begin with a well-rounded financial plan that examines your Total Financial Picture.

Today’s economy is more global in nature than ever before. It’s important to take advantage of investments that include multiple asset sectors and international opportunities.

Most clients don’t have the time and expertise to actively manage all of their investments. With this in mind, we take that responsibility seriously, and provide you with affordable and professional money management services.

We offer a wide variety of financial solutions that allow advisors to truly provide best in class investment options to their clients. Whether the goal is accumulation, tax-mitigation, income planning or Legacy planning, Wealth Watch Advisors offers unique solutions through many trusted names in the industry. Our goal is to provide you with the financial tools and training you need to help your clients understand their financial landscape and assist them with planning for their future.

We believe that training is key to success for our financial advisors. Through an extensive array of custom training modules, we provide our registered advisors with the tools they need to develop and sharpen their skills in our Wealth Watch University portal, available to our advisors online, 24/7.

We strive to use technology to our advantage as our industry continues to shift into the digital space. Our in-house custom software and third-party relationships allow us to provide our Advisors with digital platforms to easily manage client data, open and service accounts, as well as monitor performance and activity over time.

Our Operations Team members have extensive industry experience and provide 1-on-1 support to Advisors daily. Our team ensures all client account requests are completed smoothly at Charles Schwab & Co., Inc., they assist Advisors with managing daily tasks and questions, and they keep our business running efficiently in the background.

Invest with trusted names in the industry and explore diversification. Our third-party managers and trading system allow for blending multiple investment model selections together across different managers in the same account.

Our licensed Advisors can connect clients to a wide range of investment tools through diverse company relationships.

We provide our Clients and Advisors with cutting edge technology to easily manage their accounts.

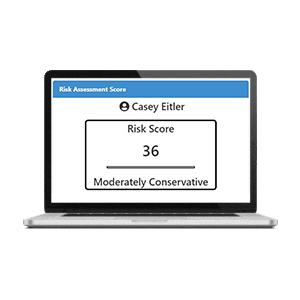

Wealth Watch Advisors has custom built client intake and survey tools to meet compliance requirements. The design is easy and simple for both Advisor and Client use.

Managed assets under Wealth Watch Advisors are custodied by Charles Schwab & Co., Inc. (Schwab). Schwab is among the largest financial custodians in the industry.